Wondering how much it costs employers to provide health insurance to employees?

Big businesses, small businesses. Old companies, new companies. Corporate organizations, start-up organizations. No matter what your company looks like—and no matter what you’re selling, creating, or offering—all businesses need to be conscious of their spending and expenses.

When an organization isn’t paying attention to their costs of production and other expenses, it can lead them down a dark path, where profit is *gulps* not as high as it should be.

However, this doesn’t mean that you should cut all your expenses to create a boring place to work that doesn’t try and give their employees and the entire organization the best chance at succeeding. When a business owner or CEO is too frugal with spending it can lead to unhappy employees, outdated tools and software, and an overall poor work environment.

For example, one expense that you should not be looking to cut, but to optimize your spending for, is healthcare. After all, your employees are working hard to help make your business great, and they deserve to be taken care of.

But, employee insurances can be expensive for your business.

We’ll be breaking down what the average cost of health insurance is per employee, as well as some other employer healthcare costs stats that you should know as we officially settle into 2021.

Table of Contents

The Average Healthcare Cost Per Employee

It’s no secret that healthcare costs are rising in the United States (for information on exactly why healthcare costs are becoming astronomical, check out this insightful blog).

Recent studies have shown that the average cost of employee insurances is on the rise and is projected to reach $15,000 per employee. According to CNBC, employers will typically cover about 70 percent of that cost, meaning the average worker will pay 30 percent of the tab.

So, as you may have guessed prior to reading this, high healthcare costs not only affect the employer but the employee as well who has to cover the amount that their employee cannot.

One of the biggest drivers of increases in healthcare costs is high-priced pharmaceuticals, which seemingly also continue to soar with the passing of every year. The U.S. spent the most per capita on drugs in 2016, with the average person shelling out $1.2k on pharmaceuticals.

Let’s take a look at some other key statistics revolved around employer healthcare costs to gain a better understanding of this cost on businesses overall.

Employer Healthcare Costs to Know

With employee healthcare costs being as high as they are, it stands to reason that business owners, CFOs, CEOs, and other members of leadership are looking for ways to cut back on costs and to control their healthcare costs.

According to a National Business Group on Health survey, entitled “2019 Large Employers’ Health Care Strategy and Plan Design,” these are the top steps businesses are taking to control their healthcare costs:

51% – Add more virtual care solutions

39% – Focus on strategy on high-cost claims

29% – Expand centers of excellence to include additional conditions

27% – Use targeted specialist pharmacy management for high-cost drugs

27% – Add a consumerism engagement platform

25% – Implement high-performance networks or accountable care organizations (ACOs) in select markets

As you can see, virtual care is a top priority for many businesses. But, using that same National Business Group on Health survey, we can dig deeper into virtual care and the specific types of care that businesses are prioritizing.

Percentage of employers currently providing this type of virtual care service

(Percentage of businesses that planned on adding those specific services in 2019 in parenthesis):

Minor, non-urgent medical issues – 95% (2%)

Mental/behavioral health services – 65% (13%)

Health and lifestyle coaching – 58% (7%)

Weight management – 54% (6%)

Diabetes care management 42% (13%)

Medical decision support – 45% (9%)

The two areas that businesses have agreed on that are crucial to focus on are mental health and diabetes care management, both of which grew by 13 percent.

This makes sense, as more and more employers are realizing the importance of ensuring that their employees are not just healthy physically, but also mentally.

In regards to diabetes care management, businesses are finally starting to realize the impact that employees with diabetes can have when it comes to their healthcare costs. Similar to employees’ mental health, employers are also making sure that their employees who have diabetes are comfortable at work and can concentrate on doing their job stress-free.

In addition to the toll on the well being of your employees with diabetes, according to Gallup and Sharecare, diabetes costs employers $20 billion in unplanned sick days per year.

But have no fear, Pops Diabetes Care is here!

How Pops’ Mina + Rebel Can Help You Save Money and Keep Your Employees Healthy

Virtual care is all the rage these days when it comes to employee insurances and healthcare benefits, and our Rebel virtual care system ensures that your employees with diabetes will be safe, healthy, and stress-free while working.

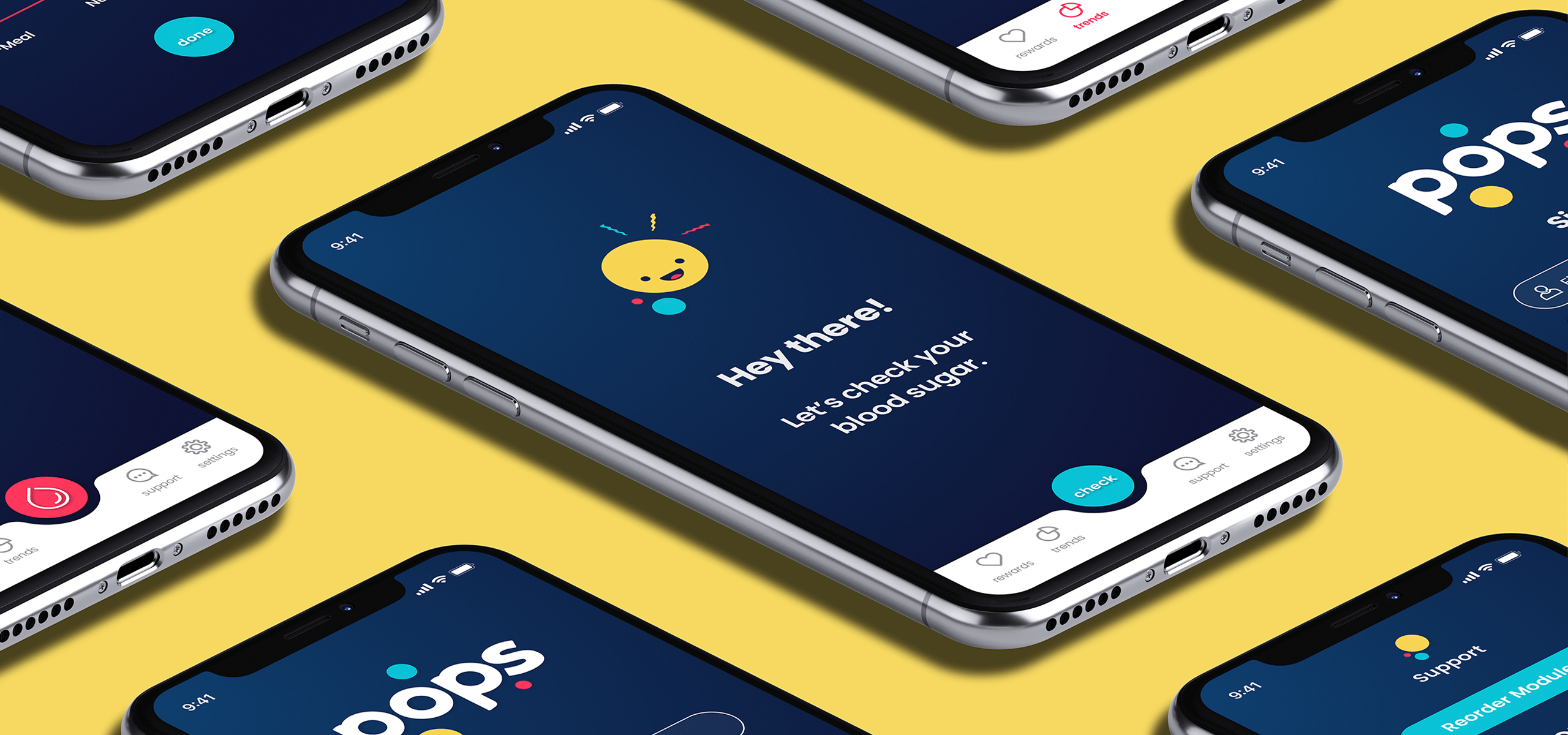

Rebel is patented, FDA cleared glucose meter that attaches directly to your employees’ phones. With the ability to test blood sugar anytime, anywhere, your team members with diabetes will be confident that they are in control at all times while at work.

Our Rebel system is accompanied by Mina, a personal virtual coach that will help your employees show diabetes who’s boss. By helping your employees set reminders, keep track of their goals, and offer a pep-talk of encouragement all from their back pocket, Mina is the ultimate virtual care assistant for employees in all industries.

And just how much money can Rebel + Mina save your company? Well, for companies with 500 employees, you can expect potential savings of $197,000. For businesses with more employees—say upwards of 7,000, you’ll experience potential savings of over $2.5 million!

Interested in learning more? Contact Pops today!